tradingwithjoe.com

THE CURRENT SITUATION

Market Type: Bull Market

Short-term Trend (10-day EMA above the 21-day EMA): Up

Long-term Trend (50-day SMA above the 200-day SMA): Up

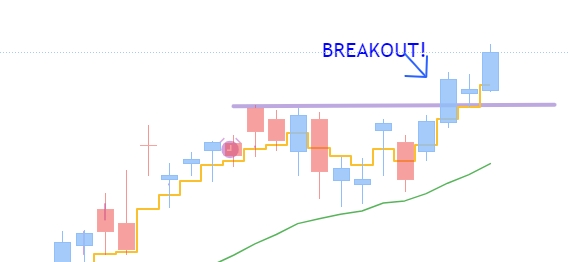

“Breakout!”

Besides an addictive Atari video game from the 80s and apparently NOT the words of the chorus in the disco song “Le Freak” by CHIC (which I have been singing wrong for decades), the S&P 500 broke out on Wednesday, Thursday, and Friday! Woohoo!! Cue the wrong words for “Le Freak”.

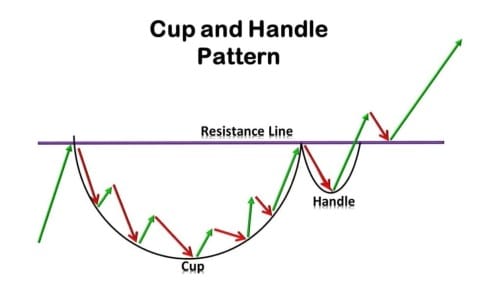

Cups ‘n handles, cups ‘n handles, cups ‘n handles

There are literally hundreds of stocks right now that are “setting up” in a trading pattern called a “cup and handle” (or cup “with” handle, but definitely not a cup with Handel...He's dead).

Why is this important?

When lots of stocks are setting up in the cup with handle pattern it's showing that "Institutions" are predominantly buying stocks.

Putting a pot of water on a stove to boil is a perfect example. Think about standing there watching the water. At first nothing happens. Minutes tick by, and still nothing is happening.

Eventually you'll see a bubble come up and maybe some steam. Then a few more bubbles. (The early steam and bubbles are like the "leaders" in the market breaking out AHEAD of the Market). Then suddenly, BOOM, the water in the pot is boiling.

That's what I see right now in the market with all of these cup and handle setups. They're shouting to us that under the surface, buying pressure is building.

When the market as a whole starts to move up, it takes the majority of stocks with it. The trading fortune cookie says: “A rising tide lifts all boats.” True dat!

Game: Find the Leader!

Let’s see how much you remember from our talk about “Laggards and Leaders.” Pick the LEADING stock from the following charts (I’ll put the answer at the P.S. under my name at the bottom).

What I'm Doing

I’m finally ALL IN!

BUT, I MUST temper my giddiness with the sobering truth that the Market CAN and WILL do whatever it wants to do. With that in mind, I always have "stop losses" on my stock positions because only God knows what will happen tomorrow.

Final Thoughts

Despite a lot of stocks prepping to participate in the uptrend, I would still like to see the Nasdaq (QQQ) and the Russell 2000 (IWM) indexes break out past their all-time highs. If they can do that and keep making new highs, we’ll have a rip-roarin’ Bull Market on our hands. If they can't, well...they'll be a bit of a drag on the overall rally, but the general trend is still up.

Remember that your money is your money and any decisions that you make trading and investing are yours alone.

Be sure to check out the Talk Like A Traderrrrr section just below. Some might call it a glossary; others just laugh.

Happy Trading/Investing!

-Joe

P.S. The leader among the four stocks shown is Meta. Remember to compare individual stock charts to the S&P 500 and ask yourself, “Is this stock ahead, at the same point as, or behind the S&P 500 (SPY)?” Netflix is at about the same point as the S&P 500 and Google is the laggard in this match up.

Talk Like A Traderrrrrr

“A rising tide lifts all boats”: A now-classic trading expression attributed to Warren Buffett meaning that when the Market goes up, it takes most of its stocks up with it. The converse saying, “When the tide goes out, you see who's been swimming naked,” is true as well. Just watch...or maybe, don't watch...what happens during the next Bear Market!

Breakout: When the price of a stock or index breaks out of a zone of resistance, like a low ceiling that it keeps bumping its head into. In good markets, after a stock breaks out, it can rally up quite vigorously and for a while! In bad markets, stock breakouts usually fail.

Cup and/with Handle: A chart pattern resembling a teacup with its handle. As long as the “handle” part of this pattern stays above the midpoint of the “teacup” on lower than usual volume, it’s considered a bullish pattern. If the handle declines lower than the midpoint of the cup or if selling comes in with much higher volume than normal, avoid this stock because the setup tends to fail.

Institutions: These are the people who actually move the market and stocks: Mutual Fund Managers, Hedge Fund Managers, Pension Fund Managers, Investment Bankers, Sovereign Wealth Fund Managers, Family Office Managers, lowly billionaires just trying to get by, and others who manage billions of dollars worth of stocks. (Aren't you glad you don't have to send them all birthday cards?) Their combined actions of buying and selling make the market and stocks move.

Laggard: An underperforming company/stock. You don’t want to own these.

Leader: A superior performance company/stock. You want to own these (as long as they lead).

Nasdaq: An exchange and index home to over 3700 stocks, many of which are technology and innovation based. Most people use the ETF QQQ to trade this index.

Russell 2000: An index that measures 2000 small-cap stocks. Most people use the ETF IWM to trade the Russell. (Not related to Russell Stover, who makes chocolates.)

Setting Up/Set Up: A stock’s price is in a good potential buy zone. It’s therefore “set up” to go up, but that’s never a guarantee that it actually will go up.

Stop or Stop Loss: An order to sell a stock automatically if a specific price is hit. Stops are a key part of risk management.

❤️ Enjoy this newsletter?

Forward to a friend and let them know where they can subscribe (hint: it's here).

Need an online broker to open a Roth IRA or trading account? I use Tastytrade (check them out here).

Need charting software? I use Tradingview (check it out here).

Anything else? Hit reply to send me feedback or say hello. 😄

(Hi, Chris.)